Turnaround picks up in third quarter for store properties

CoStar Analytics

Net absorption, or the net change in retail space occupancy, totaled 2.3 million square feet nationally during the third quarter, a significant improvement from the first half of the year when the national retail market posted negative 20 million square feet of net absorption.

The turnaround in demand was driven by a reduction in the amount of space vacated by retailers, and an increase in the amount occupied.

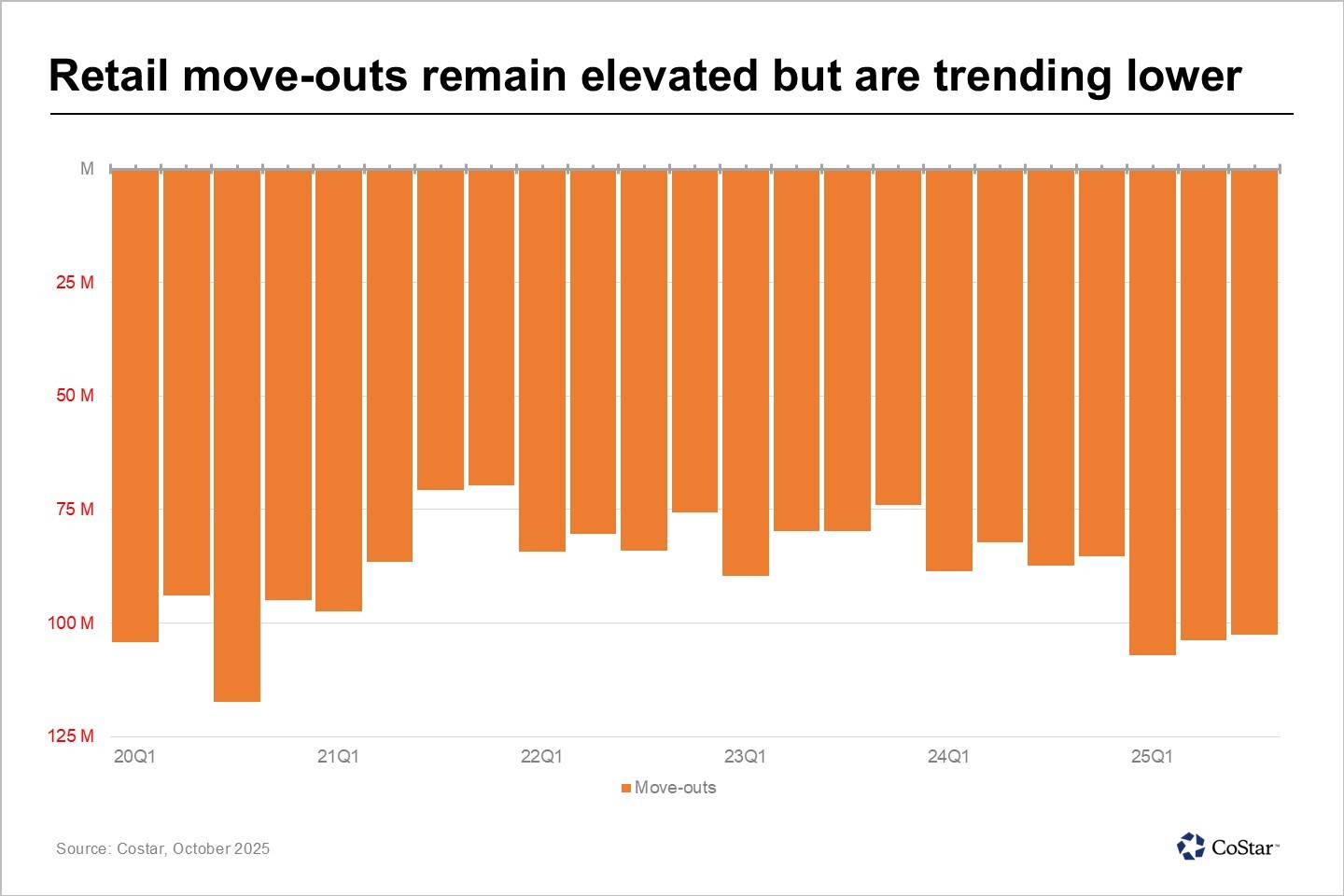

As the pace and size of store closures began to ebb after mid-year, move-outs by existing retail tenants fell by nearly 1.5 million square feet to 102.5 million square feet in the third quarter, less than the more than 107 million square feet of retail space vacated in the first quarter and the 104 million square feet vacated in the second quarter, when much of the space previously occupied by Party City, Joann’s, and Big Lots went dark.

While nearly 17 million square feet of Rite Aid space closed in the third quarter, this was far from matching the amount of retail space returned to the market from large retailer bankruptcies in prior quarters.

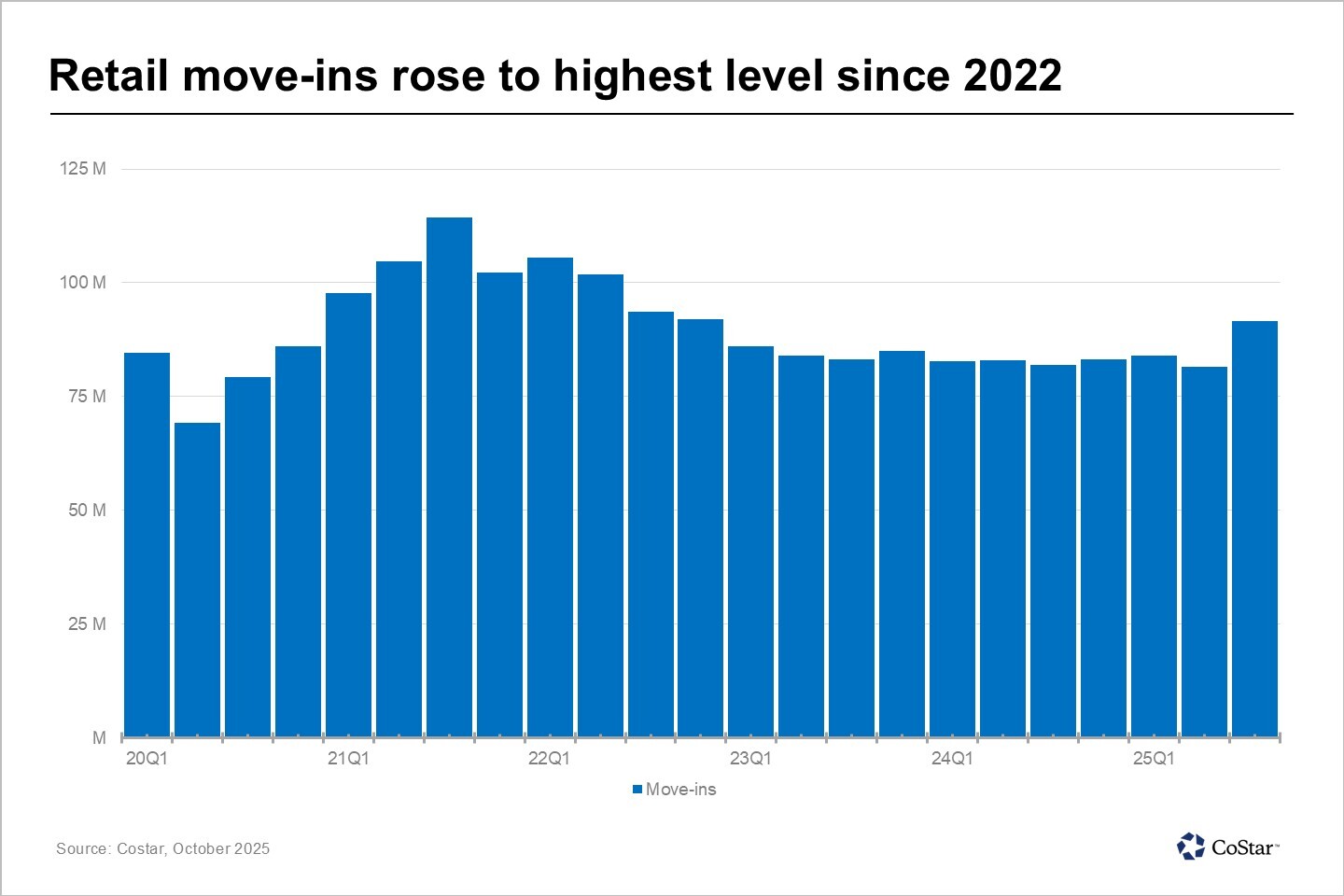

While retail move-outs slowed in the third quarter, move-ins accelerated. Tenants took occupancy of more than 91.5 million square feet of retail space in the third quarter, an increase of 10 million square feet from the second quarter and the highest quarterly total recorded in nearly three years. Retail move-ins have hovered around 83 million square feet per quarter since the start of 2023, but increased briskly as other retailers backfilled space made available by store closures in late 2024 and early 2025.

Given a lack of new construction and minimal space availability, retail tenants have been quick to fill recently vacated spaces. Nearly 40% of the retail space leased in 2025 was on the market for under five months, while the median time for retail space to lease has fallen below seven months for the first time on record.

Tenants in the fitness, value, and specialty retail segments drove leasing activity with Spencer Gifts, Dollar Tree, Burlington, Crunch, Planet Fitness and EOS Fitness signing for the most retail space during the third quarter.

Looking ahead, the U.S. retail market should continue to see increased demand for store space driven by a slower pace of tenant move-outs and increased move-ins.

Significant bankruptcy and store closure announcements by retailers have tapered since the start of summer, while much of the space that went dark as a result of the announced closures has already been vacated. As such, move-outs are expected to moderate in the coming quarters.

At the same time, move-ins should accelerate further as the rise in leasing activity seen over the past three quarters materializes into increased store openings. Given the time it takes to build out and prepare retail space for a new tenant, there is typically a one- to three-quarter delay between lease signing and move-in dates. With leasing activity steadily rising since the start of the year, we expect move-ins to accelerate in the final quarter of 2025 and into early 2026.