Despite sector reacting to recent bankruptcies, retail execs remain optimistic

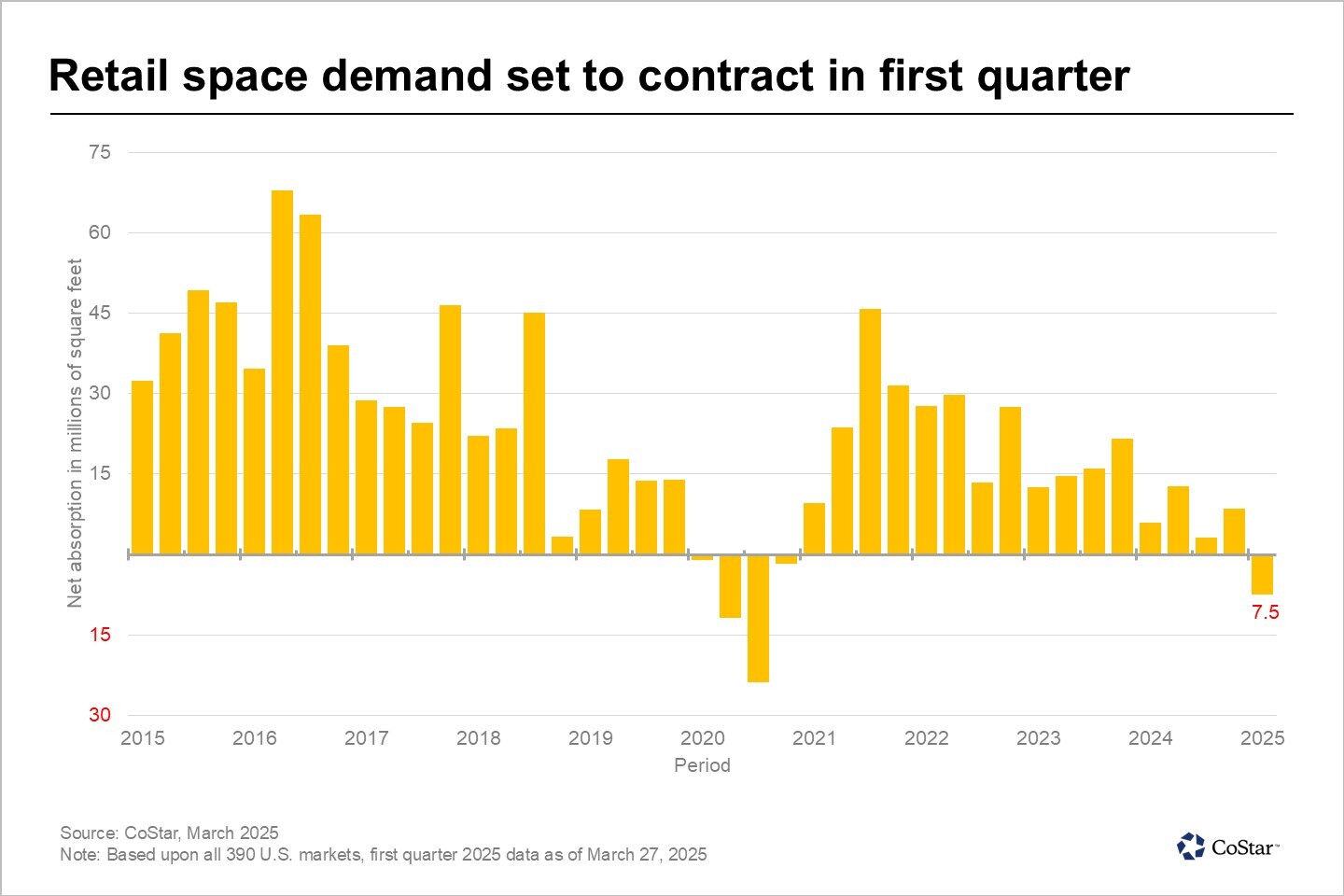

For the first time since the depths of the pandemic, retailers across the country are vacating more store space than they are filling as the effects of rising retailer bankruptcies and store closings set in.

The number of announced store closures more than doubled to over 8,700 last year — many in the fourth — and several retailers with extensive national footprints, such as Party City and Big Lots. After completing liquidation sales, these large and midsize retail boxes are going dark and creating a significant drag on demand formation, as of the first 75 days of the first quarter.

In total, demand for retail space has declined by nearly 8 million square feet since the start of the year, setting the stage for the first quarterly decline in net absorption, or the net change in occupancy, since 2020 and ending the sector’s 16-quarter streak of positive net absorption.

Net absorption is underpinned by four key components, two of which increase net absorption and two which decrease it. The two additive factors are the amount of existing retail space that tenants move into, combined with the amount of pre-leased newly built space that is completed during a period.

The two factors that offset these positive demand drivers are the amount of retail space that tenants vacate during the period and the amount of space that was demolished but occupied immediately prior to demolition. The net change in the demand for space during a period is generally driven by the mix between move-ins and move-outs, while pre-leased deliveries and demolitions of occupied space play a much smaller role.

The impact of increasing store closings is reflected in the number of move-outs, which have increased substantially over the past year, a trend that accelerated into the start of 2025. After averaging just 84.4 million square feet per quarter since the start of 2021, the number of move-outs in the first quarter of this year has already surpassed 95 million square feet, and will probably go even higher as additional announced store closures and the bankruptcy and liquidation of Joann’s 18 million square foot retail portfolio will keep move-outs elevated in the second and third quarters.

Store openings expected to increase

While store closures are acting as a drag on the retail property sector’s near-term performance, historically low availability, significant latent demand and minimal construction activity should support the orderly backfill of the recently vacated space.

At the current pace, retail move-ins appear likely to end the first quarter with about 80 million square feet, a level slightly below recent trends. However, store openings are expected to increase in the quarters ahead as spaces vacated by recent and upcoming closures are backfilled. In many instances, a lack of space availability is allowing landlords to pre-lease store closures before they go dark.

David Jamieson, chief operating officer at Kimco Realty Trust, stated on the REIT’s recent fourth-quarter earnings call: “When you’re looking at your watch list tenants, you’re constantly looking to upgrade the tenancy and prepare for what can absolutely be a bankruptcy. Obviously, with Joann and Party City, they’re both repeat filers. So when the first time happened, we were already out marketing those boxes. For example, we already have a handful of leases executed for Party City boxes before they even filed (for bankruptcy). It was just contingent on recapture.”

On the same call, Kimco CEO Connor Flynn discussed store backfill conditions by adding, “think about the lack of new supply for our sector. And then if you think of this (store closures) as shadow supply or potential opportunities for growing retailers, if you took that subset and added it to the new shopping center supply that’s under construction, it’s still extremely modest. And it’s one of the lowest, if not the lowest of the entire commercial real estate sector. So we feel very confident that because of the range of sizes of these tenants that are giving back space, we’re going to be uniquely positioned to backfill with single-tenant users at significant mark-to-market rents.”

The significant uptick in closures and resulting pullback in retail demand cannot be ignored. However, they must be considered within the context of the retail sector’s current supply-constrained conditions and the still significant number of store openings planned by expanding retailers.